Content

It’s quick and easy, but single-entry doesn’t track assets or liabilities, is prone to mistakes, and doesn’t tell you much about the health of your business. Keeping accurate bookkeeping records will make tax season a lot more manageable for your accountant. It will also give your business detailed, timely, and accurate accounting data. You are providing your bookkeeping for amazon fba business with information to make informed decisions. If your books aren’t in order or you don’t understand the numbers, it can be hard to see where you’re spending too much and receiving too little. With accurate numbers, you’ll know where to cut out expenses that may be too costly or invest more in areas where you have the opportunity for greater return.

If you’re ready to grow faster, you’ll need to free up your time to focus on higher value work. It doesn’t make sense to advertise a product that doesn’t have a high return. Instead try coupling that product with one of your better-selling SKUs, to generate attention, and eventually sales. Consider the level of customer support offered by the bookkeeping software provider. Look for software that offers reliable customer support, such as email or phone support, to help you resolve any issues that may arise. Goods and Service tax (GST) is levied on sales of all the goods and services in Australia.

Automated accounting solutions make it easier to file your taxes

This includes collecting sales tax where necessary and understanding your obligations for income tax. The software ensures that you pay the correct amount of VAT, GST, or sales tax every time. It checks each order and correctly groups it for tax purposes, potentially reducing your tax liabilities. This requires a robust accounting system that can handle the complexities of ecommerce inventory management. Keeping two separate accounts makes the distinction between the two clearer and saves a lot of time and effort if problems do arise. It also reduces legal liability and can help you to better manage your taxes and business bills.

- It’s quick and easy, but single-entry doesn’t track assets or liabilities, is prone to mistakes, and doesn’t tell you much about the health of your business.

- Enabling you to invest in and forecast for pay-per-click (PPC) advertisements, purchasing inventory, hiring, and more through creating a worst, moderate, and best-case scenario.

- Our inventory management software and data analysis ensure that you’ll always have what you need when you need it.

- Even though you may just be starting out, you can’t afford to take your eye off the inventory ball.

- You can digitally record your expenses, income, and receipts with GoogleDrive or Dropbox.

- Knowing just how much is spent on supplies and materials allows you to better spot discrepancies.

This includes things like office supplies, professional subscriptions, equipment, as well as travel, entertainment, and meals. Keeping track of seasonal sales trends is a great way to predict how much stock you need in the coming months, particularly when heading into the festive season. You should carefully account for all of your products and monitor them.

Online/

Registering your company can protect you from certain liabilities if things go wrong, and allows you to separate your business from personal income. As the business owner, you are wholly responsible for your legal and tax obligations. The IRS accepts digital records, so don’t worry about hanging on to paper receipts forever. We recommend using a cloud-based system like Dropbox, Evernote, Google Drive, or Bench. Another good practice is ensuring your Chart of Accounts gives you the right level of information.

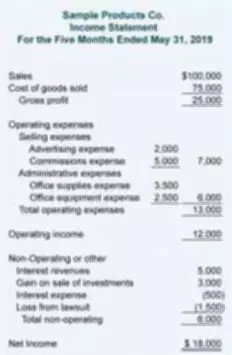

Streamline your bookkeeping process, save time, and increase efficiency. This report provides a summary of your revenues, costs, and expenses over a specific period. It’s crucial for understanding your business’s profitability.

Save time and money on a customized accounting plan

It makes it really hard to function as a regular business sometimes… Last year, before I started working with you guys, I made an appointment at my local bank determined to get a loan that didn’t feel like physical assault when it was time to pay it off.. I was a disorganized https://www.bookstime.com/ mess and the banker didn’t even bother to call me back after I left the meeting. Today, I met with 4 different banks to secure a new loan for the business… They were eager to get to the part where they pitched their financial solutions for my business…

What accounting system does Amazon use?

Amazon has been using SAP as its ERP system for its business processes. While the detailed SAP modules implemented by Amazon can't be predicted, some of the modules that have been implemented by Amazon include; SAP Basis / NetWeaver Administration.

With cloud accounting systems, you can access your books from anywhere in the world, and securely

share information as required. Once a proper accounting system is set up, it doesn’t take any longer to do the books, but

you get much more reliable data as a result. For this reason, it’s tempting to put off registering a company and paying taxes in the early days. You may reside in one state but have sales tax nexus in another, which means you’ll need to register for a sales tax permit in that state and collect sales tax from buyers in that state.

Integration of professional experts can streamline the whole accounting process.

In this post, we’ll cover the best of these options for your online store. It’s time to make bookkeeping great again for the first time. This metric shows how many times a company has sold and replaced inventory during a given period. A low turnover implies weak sales and excess inventory, while a high ratio implies strong sales. Consider performing weekly checks to manage smaller amounts of data at a time, which can be less overwhelming than waiting until the end of the month. On the other hand, the accrual method involves recording transactions as they occur, regardless of when the money changes hands.

Creating a process for regular bookkeeping will also allow you to do more traditional cash flow forecasting. Enabling you to invest in and forecast for pay-per-click (PPC) advertisements, purchasing inventory, hiring, and more through creating a worst, moderate, and best-case scenario. One of the most effective business decisions you can make today is to save the time you are spending on FBA accounting and spend it on growing the business. This software is similar to standard self-installed accounting software.

This feature should allow the seller to input data related to sales tax collected and remitted in each state where the business is required to collect sales tax. The spreadsheet can automatically calculate the amount of sales tax owed and provide an overview of the business owner’s equity sales tax liability. This feature should allow the seller to input expenses related to the business, such as FBA fees, shipping costs, inventory costs, and other expenses. The spreadsheet should automatically calculate the total expenses for each category and provide a clear overview of the total expenses incurred. For one, if you ever decide to apply for a business loan, you’ll need to provide the creditor with various financial information.

- That sounds like one of our nightmarish scenarios from earlier.

- A low turnover implies weak sales and excess inventory, while a high ratio implies strong sales.

- For one, if you ever decide to apply for a business loan, you’ll need to provide the creditor with various financial information.

- On January 1, there’s a $3,997 expense for FBA Mastery Training, which means this seller invested in Just One Dime’s membership.

- This is easy to do if your books are accurate and up-to-date.

- This could cause some real issues if you ever get audited by the IRS.

- Something I’ve found that a lot of sellers confuse is bookkeeping vs accounting.

- Then you will have categories that are defined and show where you are spending your money.